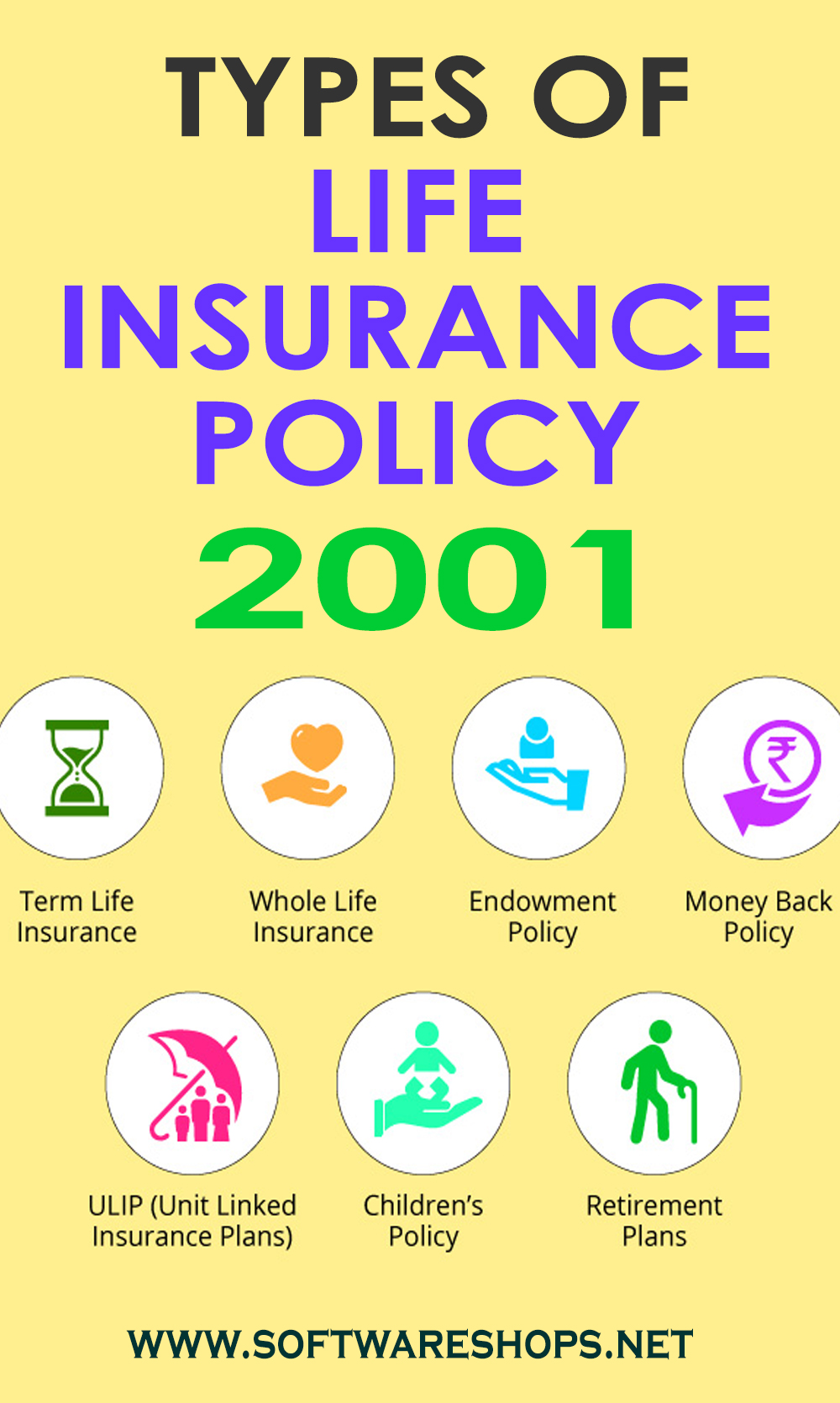

Types of life insurance

There are several types of life insurance. Basically, there are four modalities, which are: risk or death insurance, savings or survival or retirement insurance, mixed insurance, and income insurance. Each of these types of life insurance has its own characteristics. Let’s see what each one consists of.

Risk or death insurance

What s risk or death cases insurance is a type of life insurance where the contracted capital is paid immediately after the death of the insured if it occurs before the end of the term of insurance. If the insured person survives this period, the insurance is canceled, leaving the premiums paid in favor of the insurance company.

There are two types of risk insurance: term insurance and whole life insurance.

Temporary insurance

Term insurance covers the risk of premature death before the end of the contract. In this type of insurance, the risk component prevails over other variables. Its duration is one year, tacitly renewable up to a specified number of periods. Its cost is not usually very high and allows you to contract high coverage.

Temporary life insurance is usually hired to protect mortgage obligations, debt cancellation guarantees or as extra protection for the family.

Whole life insurance

For its part, whole life insurance extends its coverage throughout the life of the insured permanently, without a term. Compensation is paid immediately after the insured’s pissing, regardless of when this occurs.

Sometimes the option of restitution of the insured capital is added if he has survived a certain age, ending the contract. In this case, it would be mixed insurance, life, and death.

Regarding whole life insurance, there are two modalities:

Whole life insurance with lifetime premiums, in which the premiums are paid throughout the life of the insured, thus having continuous coverage Whole life insurance at temporary premiums, in which the payment is made only for a few years or until the death of the insured.

Savings insurance

The savings insurance or cases of supervening or retirement are aimed at obtaining capital to the end of the agreed term. The purpose of these insurances is the investment in the medium or long term to complement the retirement benefits or to accumulate capital that allows facing future situations.

Mixed insurance

The mixed insurance combines in a single contract risk insurance and insurance savings so that the insured is covered in case of death (in which case the beneficiaries receive compensation) and has secured a Rendering if he survives the age stipulated.

Income insurance

In income insurance, through the contribution of a single capital or the payment of a premium for a certain time, the insured is guaranteed a life annuity (payment of amounts while he or she lives computer Technology Articles, the amount of which can be fixed or variable) or an income temporary (for a specified time).

Note- The information provided on this page is for general purpose only and should not be taken as professional advice. All the content provided in this page is my own creativity. Thankyou So Much.